Articles & News

Lake Property Values Continue Upward Climb

Published: 09.30.2021

Low inventory supply drives values higher

The impressive run for property value increases continues for Lake Martin waterfront. We tallied the year-over-year numbers for the 12-month period ending August 31, 2021, and this year’s summer sales season indicated very impressive increases in property values.

The average price for residential* property increased 20.3% over the same period last year to $797,181. That amounts to a value increase, on average, of $134,395 over the same period in 2020. When we reported this same metric last year, we noted that the average sales price had reached record levels.

A truer indicator of the overall market is the median price which sets the mid-point for sales prices. This metric increased 26.4% for residential property to $696,337 dollars. This is an increase of $145,337 over last year’s median price of $551,000.

The average price drove an overall market volume increase of 22.5%, while the number of unit sales slowed to a more moderate increase of just 1.9%.

Value increases driven by low supply

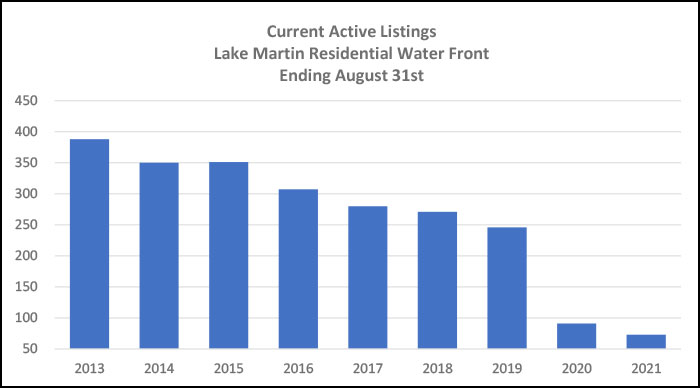

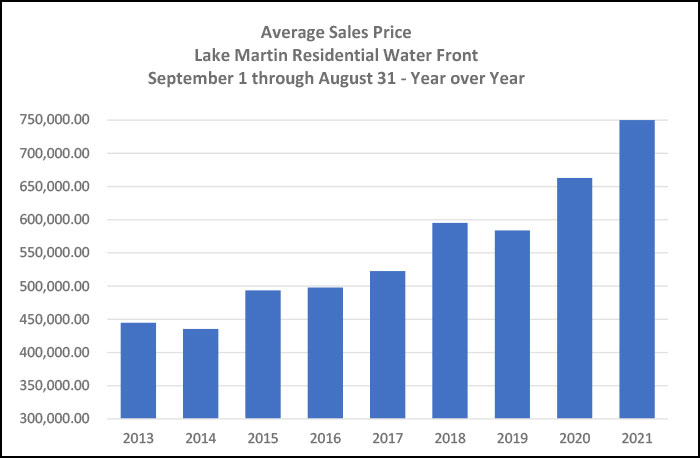

Below are two bar graphs that show the effect of supply and demand on values for lake property. The first chart, Current Active Listings, shows the levels of “for sale” inventory in the Multiple Listing Service each August dating back to 2013.

We started our analysis in 2013 because that was the first “normal” year after the financial crisis. As the chart shows, available inventory was at a high-water mark of nearly 400 properties in 2013. Then, for each of the next seven years, the available inventory dropped resulting in today’s historic low of 73 properties. (Of that number, roughly 15 are under contract for due diligence, resulting in roughly 58 unsold properties.)

The second chart, Average Sales Price, is a bar chart indicating the average sales prices for the same period of time. Average prices increased each year, with the exceptions of 2014 due to the high inventory of 2013 and 2019 when interest rates increased to 5%.

When you look at the chart, you will note that as available inventory dropped to a more moderate level in 2019 to 250 units, sales prices began to climb rapidly. When low inventory combined with a good economy, and lower interest rates, property values increased significantly.

What comes next

The news you are likely to hear about Lake Martin real estate sales will be simple to predict. Since there are few available properties, you will hear that the sales volume, whether it be month-over-month or year-over-year, will be lower than the previous period. Real estate professionals cannot sell from an empty shelf. Sellers considering parting with their lake home have an opportunity.

The other news you will hear will be that the average sales price will continue to climb due to low inventory levels and very attractive interest rates. You will also hear that the length of time a property is on the market will be very short, assuming that the property is in good condition, and the property is priced consistent to recent comparable sales.

You will also see and hear how developers and builders are working overtime in an attempt to bring on new inventory. This will eventually bring in the needed inventory supply that is required to meet a still strong demand for lake property.

We work hard to pull data that provides our clientele with data and graphs, like those mentioned above. Our goal is to help both buyers and sellers make sense of the lake real estate market so they can make wise decisions. If you would like to do a deeper dive into property values or market statistics, please reach out to one of our Realtors® today. They will be happy to share with you data that will answer your most pressing Lake Martin real estate questions.

*Residential properties noted in the report above include waterfront single-family detached homes, townhomes, and condominiums. All data utilized in the above report was derived from sales data from the Lake Martin Area Association of Realtors® Multiple Listing Service.